The data for new car registrations indicated a fall of -34% in September of this year. This puts September 2021 at the weakest prior to the twice yearly number plating system came into force (September 1999).

The industry is still blighted with supply shortages of semiconductors.

Battery power seems to be gaining favour as electric vehicles forge ahead. 32,700 makes this month the strongest yet.

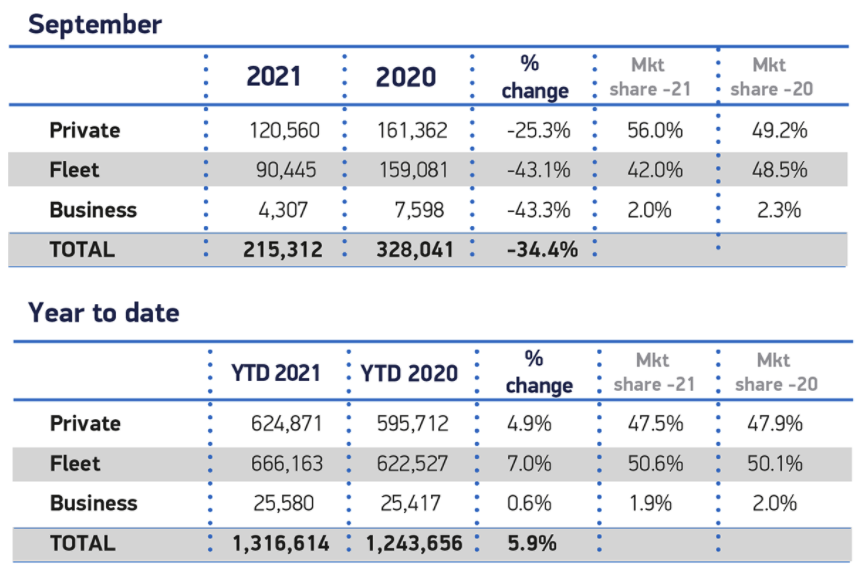

New car registration data figures September 2021 (SMMT)

According to numbers produced by the SMMT, the UK's new car market is facing its poorest September since the 2 plate format was introduced back in 1999.

September 2021 car registrations topped out at 215,300, representing a 34% fall on the previous year. in 2020. Let's not forget that activities were significantly neutered because of restrictions relating to the global pandemic.

With all things equal, September is normally placed second as the industries most productive month of the year. However, the difficulties faced obtaining semiconductors is playing havoc with the availability of some models.

Septembers performance indicates a minus figure of 45%, having factored in the 10 year average before the pandemic.

Graph of new car registration data figures September 2005 to September 2021 (SMMT)

With a 15.2% market share for electric vehicles, and also given that September was the best month (32,700) it certainly isn't all bad news. The growing, wide range of electric vehicles currently available has helped to push sales to a point where they missed a significant milestone. Just short of 5000 off the whole of 2019's total sales.

Whilst on the subject of growth, plug in hybrids aren't to be discounted either. Their share grew to 6.5%, this means the increase in Septembers registrations of zero emission vehicles is one in five.

Car registration data by fuel type September 2020 - September 2021 (SMMT)

Nearly 25,000 hybrid electric vehicles made up Septembers figures, growing their overall share of the market from 8% (2020) to 11.6% currently.

Car registration data by fuel type January 2020 September 2021 (SMMT)

Segmenting the market, there was a reduction in private demand (down some 25%), representing 120,560 September registrations. Fleets however, recorded a larger fall. A decline of 90,445 (minus 43.1%).

Because of these lacklustre figures, YTD registrations are almost 6% in front of 2020. This gives a figure of minus 29% on the decade long average (pre pandemic).

Car registration data by private business fleet September 2021 (SMMT)

In summary, semiconductors are stalling supply. This is despite strong demand for vehicles over the summer period.

Electric vehicle demand continues to grow from strength to strength. Charging infrastructure needs to keep pace with this demand if all drivers are to make the switch.